Registration under GST

Registration of an assessee or a ‘taxable person’ is the starting point in any tax law. It is the most fundamental requirement of identification of the business for tax purposes and monitoring compliance requirements.

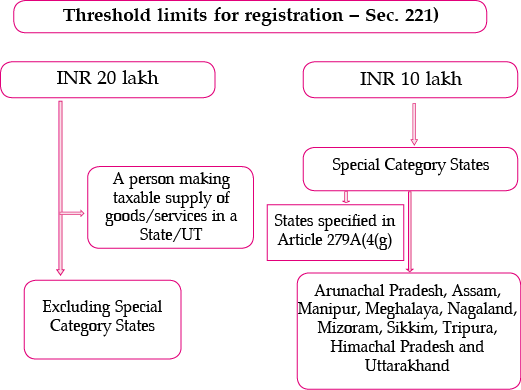

CGST Act provides for registration of every supplier effecting the taxable supplies. Every supplier having aggregate turnover exceeding ₹ 20 lakh in the financial year is required to be registered. This threshold limit of ₹ 20 lakh is reduced to ₹ 10 lakh in cases of supplies effected in the States of Himachal Pradesh, Uttarakhand, Manipur, Arunachal Pradesh, Assam, Jammu & Kashmir, Meghalaya, Mizoram, Nagaland, Sikkim, and Tripura. For calculating the threshold limit, supply of goods by a registered Job-worker after completing job-work, shall be treated as the supply of goods by the "principal" and shall not be included in the aggregate turnover of the registered job-worker.

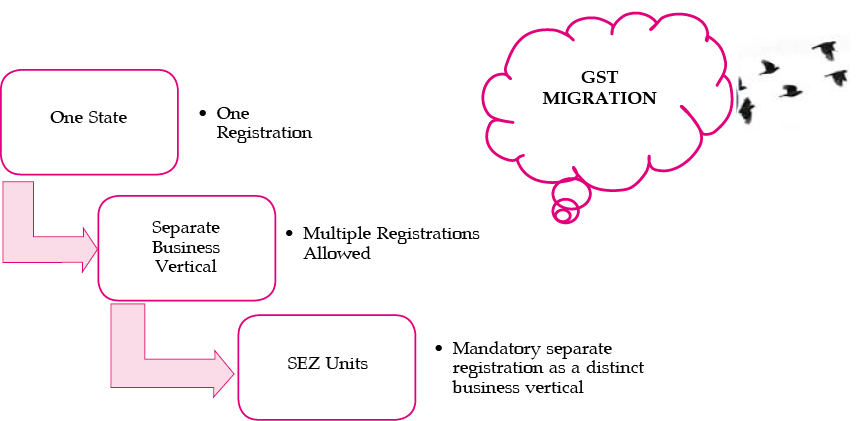

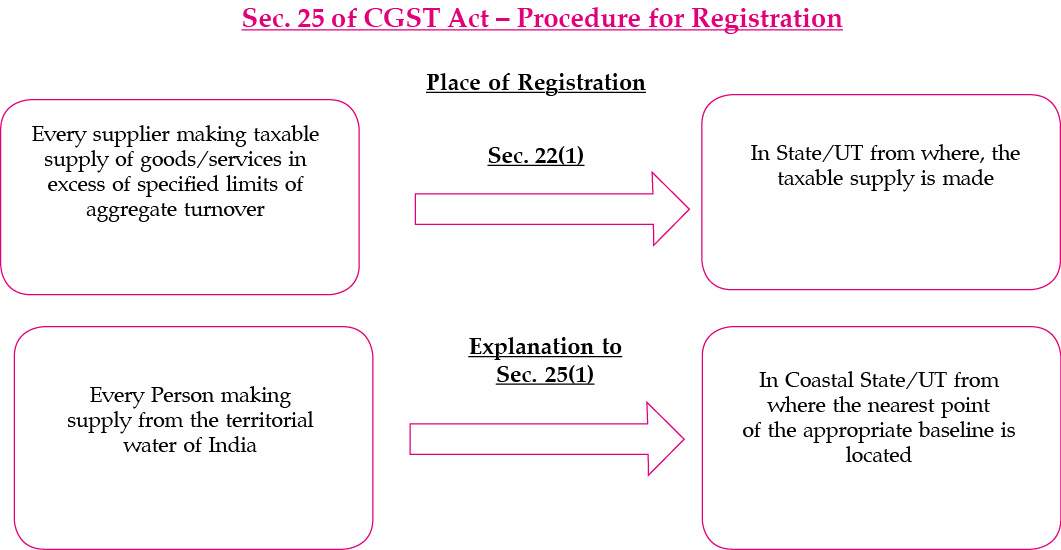

Registration, under GST, is a State-wise requirement which means a person making supplies in every State is required to be separately registered in that State once the threshold limit is crossed taking to account supplies from all States. Such a person making taxable supplies from different places in the State will be required to take one registration in the State, except in case of business verticals in which case multiple registrations are permitted within a State. If a taxpayer supplies from different places in the State, he has to opt for one place as “principal place of business” and mention all other places in the State as “additional place of business” at the time of obtaining registration. The application for registration will have to be made within 30 days from the date the liability of registration arises.

A business vertical means a distinguishable component of an enterprise that is engaged in the supply of individual goods or services or a group of related goods or services which is subject to risks and returns that are different from those of the other business verticals and for this purpose the following factors shall be considered:

- The nature of the goods or services;

- The nature of the production processes;

- The type or class of customers for the goods or services;

- The methods used for distribution of goods or supply of services; and

- The nature of regulatory environment (wherever applicable), including banking, insurance, or public utilities.

All the existing taxpayers (under Excise, VAT or Service Tax) are not eligible for threshold limit exemptions. They have to compulsorily migrate and obtain provisional registration from GSTN before the appointed day, irrespective of the fact that their turnover is less than threshold limit specified in the GST Law. However, such taxpayers can opt out from the provisional registration if their supplies are not covered under GST or they are within the threshold limit.

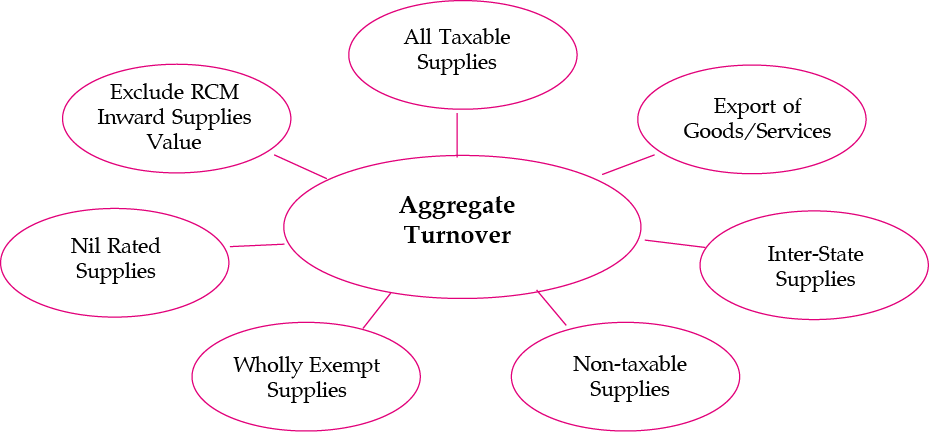

Aggregate turnover is defined to mean the aggregate value of all taxable supplies, exempt supplies, export of goods or services or both and inter-State supplies made by the person having same Permanent Account Number to be computed on the all India basis. However, Central Tax (CGST), State Tax (SGST), Union Territory Tax (UTGST), Integrated Tax (IGST) and Cess are not to be included in such supplies. Further, value of inward supplies on which tax is payable on reverse charge basis is also to be excluded.

A Special Economic Zone unit or developer shall make a separate application for registration as a business vertical distinct from its other units located outside the Special Economic Zone.

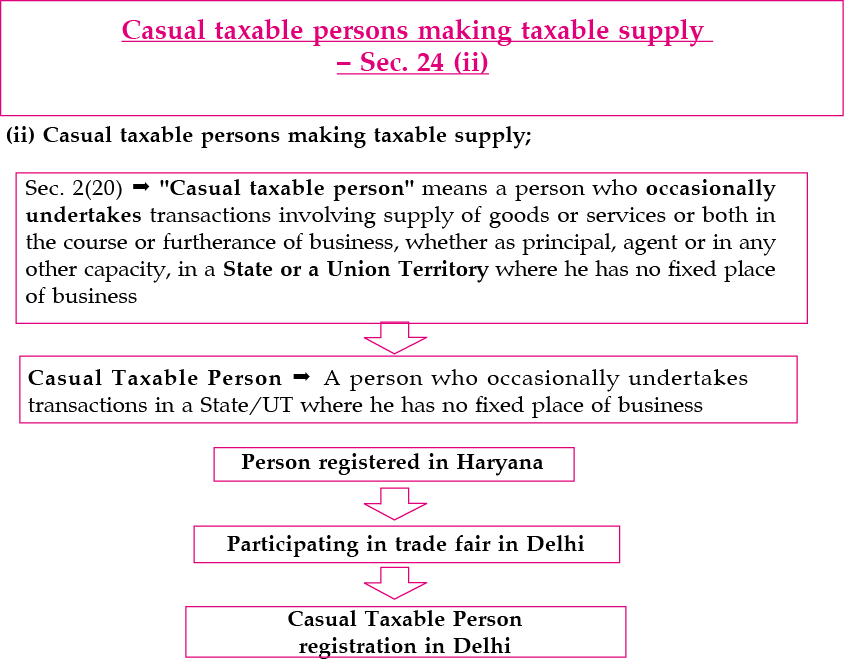

A casual taxable person or a non-resident taxable person shall have to apply for the registration at least 5 days prior to the commencement of business. A casual taxable person is one who occasionally undertakes transaction involving supply of goods for services or both in the course or furtherance of business in a State or Union Territory where he does not have fixed place of business. A non-resident taxable person is one who occasionally undertakes transaction involving supply of goods for services or both in the course or furtherance of business but not having fixed place of business or residence in India.

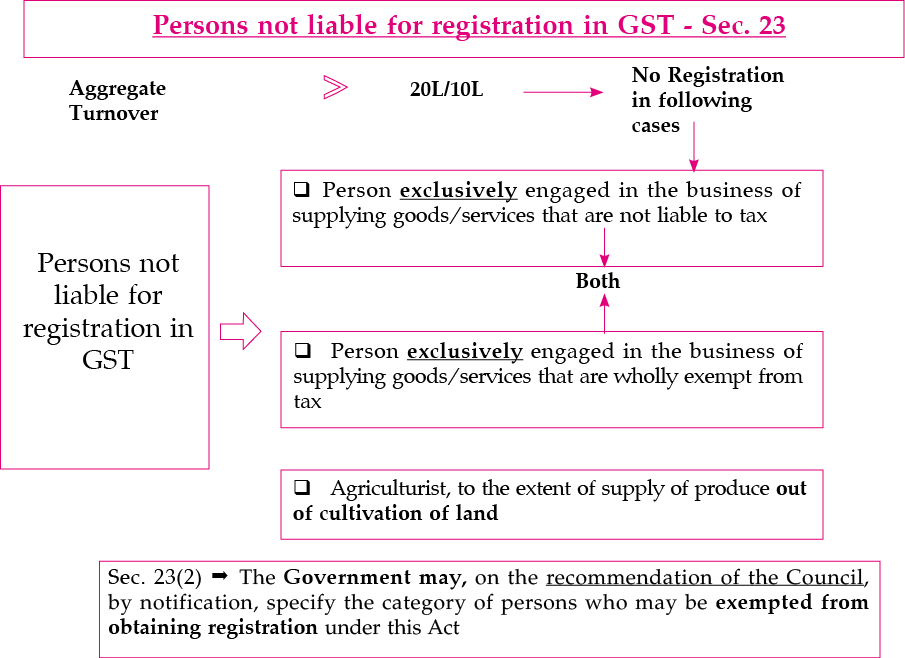

PERSONS NOT LIABLE FOR REGISTRATION IN GST

CATEGORIES OF PERSONS WHO ARE REQUIRED TO BE REGISTERED IRRESPECTIVE OF THE THRESHOLD

- Person making any inter-State taxable supply;

- Casual taxable person making taxable supply;

- Persons who are required to pay tax under reverse charge;

- Electronic commerce operator undertaking supplies on behalf of other suppliers (liable to discharge tax liability for supply of services as may be notified)

- Non-resident taxable person making taxable supply;

- Persons who are required to deduct tax at Source under GST;

- Persons who supply goods or services or both on behalf of other registered taxable person whether as an agent or otherwise;

- Input service distributor;

- Every electronic commerce operator;

- Every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered taxable person;

- Such other person or class of persons as may be notified by the Central Government or a State Government on the recommendations of the Council.

FOLLOWING PERSONS ARE NOT LIABLE FOR REGISTRATION

- Any person engaged exclusively in the business of supplying goods or services or both that are not liable to tax or wholly exempt from tax under CGST or under the Integrated Goods and Services Tax Act

- An agriculturist, to the extent of supply of produce out of cultivation of land

- Government may, on the recommendations of the Council, by notification, specify the category of persons who may be exempted from obtaining registration under this Act.

VOLUNTARY REGISTRATION

Provisions are made for a person, though not required to be registered, may get himself registered voluntarily.

DEEMED REGISTRATION OR REJECTION OF APPLICATION FOR REGISTRATION AND CANCELLATION OR REVOCATION OF REGISTRATION CERTIFICATE

Any grant of registration or Unique Identity Number under any SGST or UTGST shall be construed as grant of registration under CGST. Similarly, any grant of registration or Unique Identity Number under CGST shall be construed as grant of registration under SGST or UTGST, as a case may be. Any rejection of application for registration or cancellation or revocation of registration shall be treated likewise.

TRANSFER OF BUSINESS AND REGISTRATION

A transferee, or the successor of a business on-going concern basis shall be liable to be registered with effect from the date of such transfer or succession. In a case of transfer pursuant to sanction of a scheme or an arrangement for amalgamation or, demerger of two or more companies by an order of a High Court, the transferee shall be liable to be registered with effect from the date on which the Registrar of Companies issues a certificate of incorporation giving effect to such order of the High Court. This means that the Registration Certificate issued to a person is not transferable to any other person.

SPECIAL PROVISIONS RELATING TO CASUAL TAXABLE PERSON AND NON-RESIDENT TAXABLE PERSON

The Certificate of Registration issued to a casual taxable person and non-resident taxable person shall be valid for 90 days from the effective date of registration or any earlier period as specified in the application. An extension of period not exceeding 90 days may also be granted on sufficient cause being shown. An advance deposit of tax shall be credited to the electronic cash ledger equivalent to the estimated tax liability for the registration period sought.

SUO MOTU REGISTRATION BY THE DEPARTMENT

During the course of any survey, inspection, search, enquiry or any other proceeding under the Act, it is found that a person liable to register has failed to apply for the same, proper officer may register such person on temporary basis and issue order in FORM GST REG-12. Registration will be effective from the date of order. Such person is required to apply for registration within 30 days from the date of such temporary order, unless he files an appeal against such order.

AMENDMENT TO REGISTRATION

There are various situations in which the Registration issued by the competent authority requires amendment in line with real time situations. In such a case, every registered taxable person shall inform any changes in the information furnished at the time of registration within 15 days of such changes.

The proper officer cannot reject the request for amendment without affording a reasonable opportunity of being heard by following the principles of natural justice.

CANCELLATION OF REGISTRATION

A registration granted can be cancelled by the proper officer either on his own or on application of the registered person when —

- The business is discontinued, transferred fully for any reason including death of proprietor, amalgamation with other legal entity, demerged or otherwise disposed of, or

- There is any change in the constitution of the business, or

- The taxable person is no longer liable to be registered.

Registration may be cancelled retrospectively if the proper officer so deems fit in any of the following situations after giving the person an opportunity of being heard:

- Registered person has contravened such provisions of the Act or Rules;

- Person paying tax under Composition Scheme has not furnished returns for 3 consecutive tax periods;

- Any taxable person has not furnished returns for a continuous period of 6 months;

- Person who has taken voluntary registration has not commenced business within 6 months from the date of registration;

- Registration has been obtained by means of fraud, wilful misstatement or suppression of facts.

As such, cancellation of registration shall not affect the liability of the taxable person to pay tax and other dues under the Act for any period prior to the date of cancellation whether or not such tax and other dues are determined before or after the date of cancellation.

Where the registration is cancelled, the registered taxable person shall pay an amount equivalent to the credit of input tax in respect of inputs held in stock and inputs contained in semi- finished or finished goods held in stock on the day immediately preceding the date of such cancellation or the output tax payable on such goods, whichever is higher. The payment can be made by way of debit in the electronic credit or electronic cash ledger.

In case of capital goods, the taxable person shall pay an amount equal to the input tax credit taken on the said capital goods reduced by the percentage points (to be prescribed) or the tax on the transaction value of such capital goods whichever is higher.

REVOCATION OF CANCELLATION OF REGISTRATION

Any registered taxable person, whose registration is cancelled, may apply to proper officer for revocation of cancellation of the registration within thirty days from the date of service of the cancellation order.

The proper officer shall not reject the application for revocation of cancellation of registration without giving a show cause notice and without giving the person a reasonable opportunity of being heard.

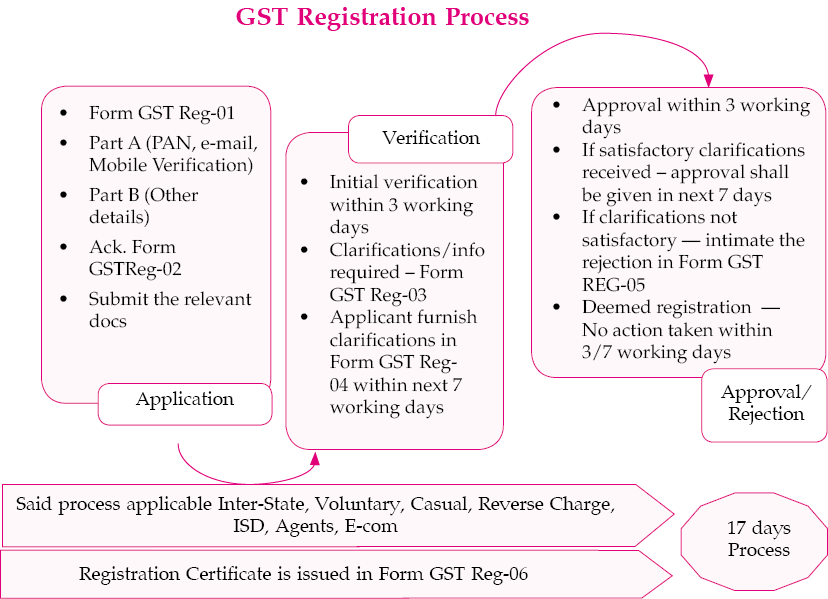

PROCEDURE FOR REGISTRATION

- Online application to be made in FORM GST REG-01 by declaring PAN, mobile number, email address, State or UT, along with other documents duly signed and electronically verified. Persons who are liable to deduct TDS or collect TCS shall apply in FORM GST REG-07. Non-resident taxable person shall apply in FORM GST REG-09. A non- resident taxable person shall be allotted a Temporary Reference Number for making an advance deposit of estimated tax liability.

- Acknowledgement will be generated in FORM GST

REG-02.

- Proper officer shall either grant registration or issue a notice in FORM GST REG-03 for any additional information and clarification within 3 working days. Applicant should reply in FORM GST REG-04 within 7 working days from date of receipt of notice. If applicant fails to reply, proper officer may reject the application in FORM GST REG-05 or if he is satisfied with the information furnished then he may grant registration within 7 working days

- Registration Certificate will be issued in FORM GST

REG-06.

DOCUMENTS REQUIRED FOR REGISTRATION

|

Particulars

|

Documents required

|

|

Constitution of Business

|

•

|

Partnership Deed in case of Partnership Firm

|

| |

•

|

Registration Certificate in cases of other business viz., Company, Society, Trust etc.

|

|

Principal Place of Business

|

•

|

In case of own Premises

|

|

•

|

Any document in support of the ownership of premises viz. Electricity Bill or Municipality Bill

|

|

•

|

In case of Rented or Leased Premises

|

|

•

|

Valid Rent/Lease agreement

|

|

•

|

Latest paid invoice of Electricity Bill or

|

|

•

|

Latest paid bill of Municipality Bill

|

|

•

|

In cases of other than by way of Rent/Lease

|

|

•

|

Consent Letter from Consenter

|

|

•

|

Any document in support of ownership of premises of the Consentor

|

|

Details of Bank Account

|

Opening page of bank pass book or Statement in the name of Business Concern containing –

|

|

•

|

Account Name of Business

|

|

•

|

Account Number

|

|

•

|

MICR and IFS Code

|

|

•

|

Branch Details

|

|

Details of Authorised Signatory

|

Letter of Authorisation/Board Resolution of the Managing Committee or Board of Directors, for each Authorised Signatory.

|

|

Photograph

|

In case of Proprietary Concern – Proprietor

|

|

Managing/Authroised Person – Partnership Firm

|

|

Karta – HUF

|

|

Managing Director/Authorised person – Company

|

|

Managing Trustee – Trust

|

|

Local/Statutory Body – CEO or his equivalent

|

LIST OF FORMS FOR REGISTRATION

|

Sr. No.

|

Form Number

|

Content

|

|

1

|

GST REG 01

|

Application for Registration

|

|

2

|

GST REG 02

|

Acknowledgement of Application

|

|

3

|

GST REG 03

|

Notice for seeking additional information/clarification/ documents relating to application for registration/amendment/cancellation

|

|

4

|

GST REG 04

|

Application for filing additional information/clarification/ documents relating to application for registration/amendment/cancellation

|

|

5

|

GST REG 05

|

Order of Rejection of application of Registration

|

|

6

|

GST REG 06

|

Registration Certificate

|

|

7

|

GST REG 07

|

Application for Registration of Tax Deductor or Tax Collector at Source

|

|

8

|

GST REG 08

|

Order of Cancellation of Tax Deductor or Tax Collector at Source

|

|

9

|

GST REG 09

|

Application for allotment of Unique ID to UN Bodies/Embassies etc.

|

|

10

|

GST REG 10

|

Application for Registration of Non- Resident Taxable Person

|

|

11

|

GST REG 11

|

Application for amendment in particulars subsequent to registration

|

|

12

|

GST REG 12

|

Order of amendment of existing registration

|

|

13

|

GST REG 13

|

Order of allotment of temporary registration/Suo motu registration

|

|

14

|

GST REG 14

|

Application for cancellation of COR

|

|

15

|

GST REG 15

|

SCN for cancellation of registration

|

|

16

|

GST REG 16

|

Order of cancellation of registration

|

|

17

|

GST REG 17

|

Application for revocation of cancelled registration

|

|

18

|

GST REG 18

|

Order of approval of application for revocation of cancelled registration

|

|

19

|

GST REG 19

|

Notice for seeking clarification/ documents relating to application for revocation of cancellation

|

|

20

|

GST REG 20

|

Application for enrolment of existing taxpayer

|

|

21

|

GST REG 21

|

Provisional Registration Certificate to existing taxpayer

|

|

22

|

GST REG 22

|

Order of Cancellation of provisional certificate

|

|

23

|

GST REG 23

|

Intimation of discrepancies in application for enrolment of existing taxpayer

|

|

24

|

GST REG 24

|

Application for cancellation of registration for the migrated taxpayers not liable for registration

|

|

25

|

GST REG 25

|

Application for extension of registration period by casual/non-resident taxable person

|

|

26

|

GST REG 26

|

Form for Field Visit Report

|

Back to Top

|