- Learning

Learning

High-quality curated learning offerings through multiple formats on contemporary topics of professional importance.

Learn More

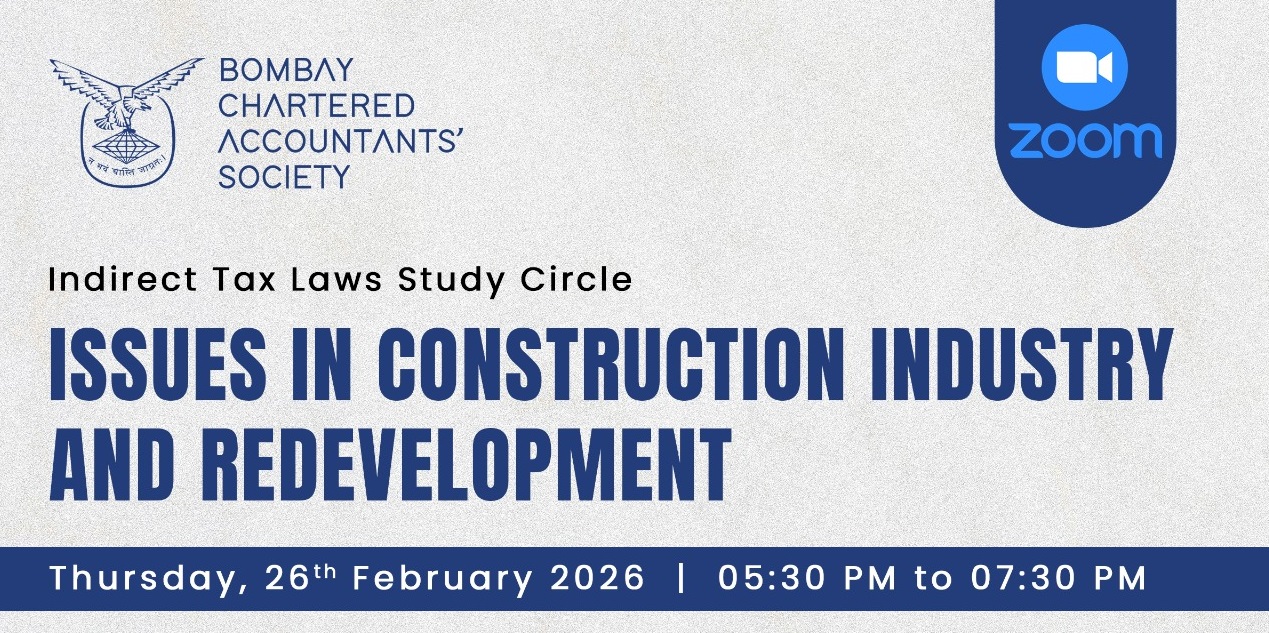

Indirect Tax Laws Study Circle Meeting on “Issues in Construction Industry and Redevelopment”

Read MoreNo data found.

- Journal & Publications

Journal & Publications

Stay abreast with the latest developments in the professional domain along with in-depth analysis through the monthly BCA Journal. Get access to an engaging library of researched publications from the BCAS stable.

Learn More - Advocacy & Thought Leadership

Advocacy & Thought Leadership

BCAS through its advocacy initiatives has been a vital catalyst towards effective regulatory regime and public policy in areas of accounting, taxation, financial and related domains.

Learn MoreSEBI (Research Analysts) Regulations – Key Industry Issues Requiring Regulatory Clarification

Read MoreRenewal of Registration u/s 12A of the Income Tax Act, 1961 – Insistence on Existence of Irrevocable Clause in Trust Deed

Read MoreFollow-up Representation on Challenges in Filing FORM GSTR-9 and GSTR-9C and Request for Extension of Due Date

Read More - About BCAS

About BCAS

BCAS is a knowledge-driven, apolitical, ethical voluntary organization working towards the professional development of Chartered Accountants for the past 75 years,

Learn MoreAbout BCAS

The Bombay Chartered Accountants’ Society (BCAS) is one of the largest and oldest independent and voluntary bodies of Chartered Accountants in India. With membership & subscribers exceeding 11,500 and a widespread presence across 400+ cities and towns in India, BCAS has been unwavering in its commitment towards the development of the profession since its inception in 1949.

Introducing you to the Bombay Chartered Accountants’ Society

BCAS is a uniquely positioned pan-India voluntary organisation of Chartered Accountants established in 1949 represented by membership across 400+ cities\towns of India. BCAS endeavours to be a principle-centred, learning-oriented organisation promoting quality professional education, networking and excellence in the profession of Chartered Accountancy. BCAS acts as a catalyst for better and more effective regulatory policies for cleaner and more efficient administration and governance.

The BCAS Legacy

Founded just six days after the Institute of Chartered Accountants of India in the year 1949, the BCAS is, in many ways, the torchbearer for the profession.

With an intent to inspire and nurture the professional spirit within its members, BCAS introduced novel features such as the long-term residential and non-residential refresher courses, the lecture meetings, the study circles, the workshops, the Referencer, the BCA Journal, publications. BCAS provides its membership base access to a sustainable, cutting edge and holistic learning platform, underlined by a reliable and knowledgeable network to confer and synergise with.

Center for Professional Development

The BCAS Centre of Excellence is a versatile space that caters to the diverse needs of its members – serving as a training centre or as a meeting room for various committee meetings, study circle meetings, lecture meetings, seminars, etc. The well-appointed library has a rich collection of books of professional interest.

BCAS Foundation

Established in May 2002, the BCAS Foundation is the social wing of the BCAS. Recognising the need to channel the philanthropic obligation that rests on the shoulders of every conscientious citizen, the main objectives of the BCAS Foundation are:

- Membership

Membership

Your BCAS membership offers you a host of advantages and benefits. Learn, network and engage towards a gratifying professional journey.

Learn MoreGet involved with India’s largest and oldest voluntary body of Chartered Accountants. Learn, Share and Network with peers and mentors towards building lifelong relationships.

Octago Advisory Solutions LLP

Axar Digital Services Private Limited

Vyapar TaxOne (Formerly Suvit)