BCAS President CA Chirag Doshi’s Message for the Month of September 2023

Dear BCAS Family,

Let’s go invent tomorrow instead of worrying about what happened yesterday – Steve Jobs

India is reinventing itself and is gearing up to leap into the future with aggressive digital transformation. The e-initiatives that are enabling India to take rapid strides in transforming itself from a developing economy to a developed economy are Unified Payment Interface (UPI), Digilocker, e-sign, Aadhaar-enabled payments, E-KYC, GSTIN, TIN, Aarogya Setu, Co-win, FasTag, e-way bill, National Digital library, ONDC, and many more.

As per NASSCOM report, in FY2023, India’s technology industry revenue, including hardware, is estimated to cross $245 Bn. The domestic technology sector is expected to reach $51 bn, on the back of continued investments by enterprises and the government.

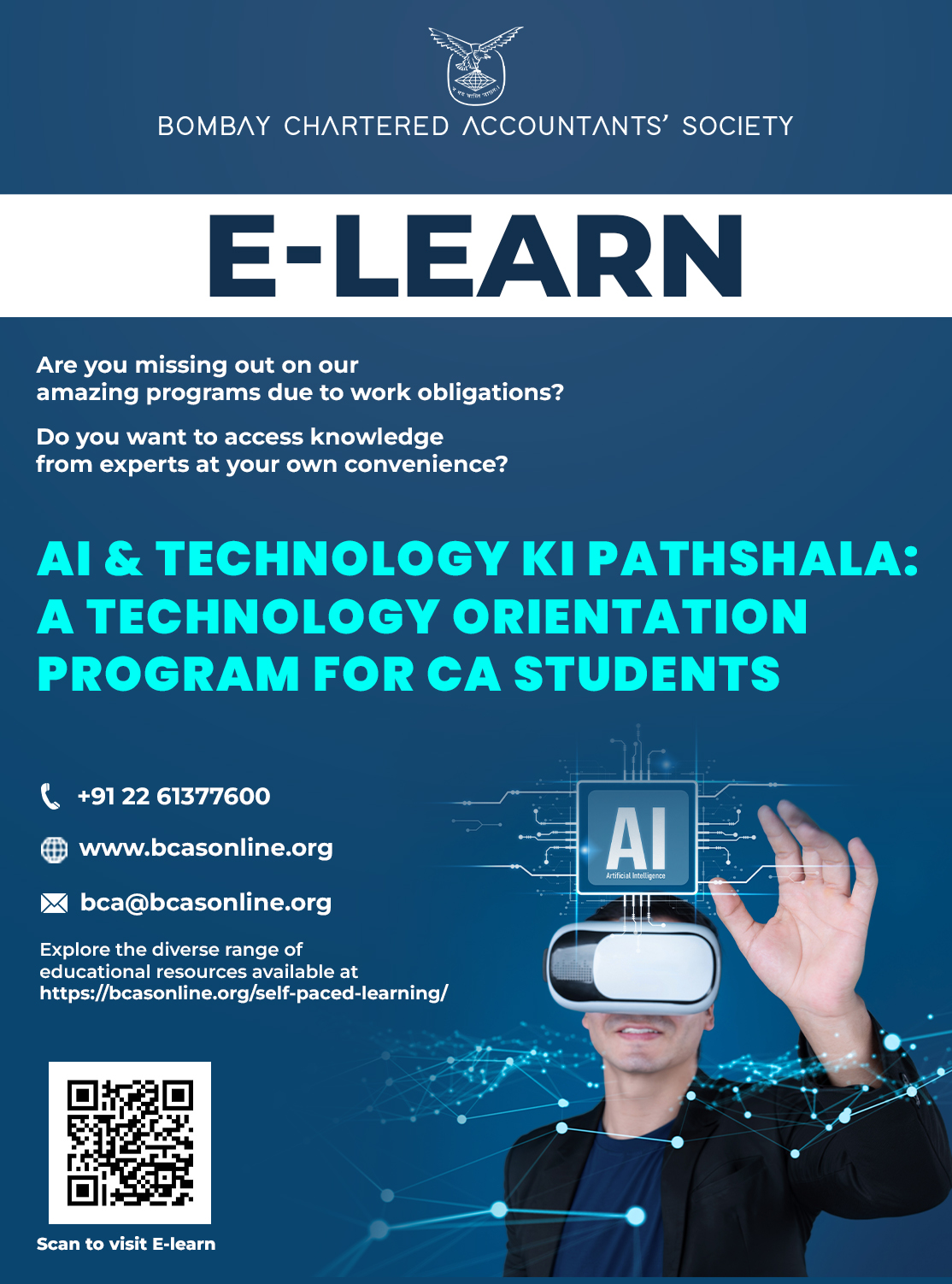

I also read a report and came across a few technologies that would change how we live, work, study, commute, and interact. Artificial intelligence (e.g. creative AI), Quantum computing, Green technology (e.g. Autonomous vehicles), Virtual Offices, Video conferencing, Robotics, Virtual reality, Blockchain (e.g. Web3), Spatial computing, Predictive Analysis, Health tech, etc.

ONDC – Reimagining digital commerce

A digital initiative of the Government of India, which will be a real game changer and which has the potential to bring power to the masses of India, is Open Network Digital Commerce (ONDC).

The open network could unleash many things like:

- Boosting the direct-to-consumer (D2C) ecosystem.

- Self-employed Professional – One of the important aspects of ONDC is how it will put self-employed professionals on the Map; self-employed people could more easily promote themselves in an open, inclusive marketplace, attracting attention and business from consumers

- Digitalising B2B commerce – Retailers could access a wider distribution network to save time and costs, and improve margins.

- Taking financial services further – ONDC’s transaction-based data could support innovative new offerings to provide businesses with greater access to credit.

- Growing peer-to-peer commerce -The decentralised network would enable peer-to-peer commerce among consumers, peer sellers, and self-employed professionals.

- Empowering people with education and skills – More learners and workers could access skills-based education, vocational training, career counselling, and career opportunities, which could engender a more equitable, skills-driven labour market in India.

- Taking India to the world – India’s digital commerce infrastructure could promote cross-border trade via marketplaces, helping MSMEs become discoverable by global consumers and businesses.

For ONDC to transform digital commerce beyond the borders of India, four key enablers should ideally be in place: seamless cross-border payment settlements, stringent grievance redressal systems, a globalised taxonomy, and global cooperation to support digital commerce.

One of the areas in which the ONDC platform shall impact the most is the Independent professionals or unorganised labour force offering skilled services. The Indian economy has largely been informal, with an unorganised labour force of around 380 to 400 million. Only 8 to 10 million of the workforce are on digital platforms. Rising internet speeds enable remote service offerings and upskilling could create opportunities for self-employed individuals, and a unified, decentralised, low-cost, reliable digital ecosystem could provide such professionals with the necessary boost.

As per a McKinsey report, there are 800+ million active online consumers, of which approx. 300 – 350 million are digital payment users, 165 – 190 million are e-retail transactors and only 1 to 2 % i.e. 10 to 15 million are regular transactors in e-commerce. These statistics provide humongous opportunities for expanding e-commerce nationally and internationally.

Indian Government is not leaving any stone unturned to unleash the potential of technology for the citizens of India, thereby transforming India into a Digital Economy. I would like to highlight, some of the initiatives in the technology sector taken by the Government of India:

- Centres of Excellence for:

- Internet of Things (Gandhinagar, Bengaluru, Gurugram & Vizag)

- Virtual & Augmented Reality (VARCoE) at IIT Bhubaneswar

- Gaming, VFX, Computer Vision & AI at Hyderabad

- Blockchain Technology at Gurugram

- Design, Development, and Deployment of National AI Portal (INDIAai)

- POC for AI Research Analytics and Knowledge Dissemination Platform (AIRAWAT)

- Formation of Inter-Ministerial Committee for Development of Robotics Ecosystem in the country

- Global Partnership on Artificial Intelligence

- National Program on Artificial Intelligence

- Artificial Intelligence Committees’ Reports

Indirect Taxation on Gaming in India

The latest decision by the GST Council has surprised the gaming industry in India, which is estimated to be worth around $ 2.8 billion in FY22. Regarding online games in India, taxation and legality largely depend on whether they are considered a game of chance or a game of skill. The Finance Minister has said that the tax will be levied on the entire value. Hence the tax will essentially be levied on the full face value of the bet placed and not on the gross gaming revenue, which the industry sought.

Globally, there are two GST models in the taxation of the gaming industry: Gross Gaming Revenue (GGR) and Turnover Tax Model. As per the Indian Express article, the GGR is essentially the total amount of money a gambling business brings in through bets, deducting the amount that is paid for the win. Meanwhile, the turnover tax model is the tax levied on income from winnings of real money from online games. Here, the entire prize pool is taxed. Countries such as the UK, Australia, Italy, Sweden, Singapore, Malaysia, etc., follow the GGR Model.

From the experiences internationally, there may have to be a rethink of indirect taxation on gaming in India to ensure its survival and growing contribution to the tax kitty.

Hyderabad visit

I, along with 2 of our past presidents CA Uday Sathaye and CA Narayan Pasari, visited Hyderabad to meet the members in person and discuss the 5-year plan of BCAS. We interacted with them to understand the need on the ground and how BCAS can become part of their professional upliftment journey. Hyderabad is the city of pearls as many professional pearls attended this meeting at the G P Birla Auditorium on 14th July 2023. The young CAs had also come to attend the meeting with several hopes in their eyes, a thirst for knowledge, and dreams to do something new and contribute back to society. Several youngsters were interested in contributing to the research project of BCAS. The other ground requirement was to start a study circle of BCAS in their city. It was also great to interact with our members who had traveled from Secunderabad, Guntur, Madurai, Vijayawada, and other nearby cities and towns.

Meeting with Registrar of Companies

During this month, I, along with CA Abhay Mehta, Chairman of the Corporate and Commercial Laws Committee, and CA Shardul Shah, Core committee member, had a meeting with the Regional Director, ROC, Mumbai, Ministry of Corporate Affairs. We had a good discussion with regard to the importance of related party transactions and ultimate beneficiaries. We shall have more such interaction with ROC team members.

BCAS वन

BCAS, as its green initiative in its 75th year, has been instrumental in planting 7500 trees in the drought-prone area of Banaskantha Gujarat. The area where these trees are planted shall be called BCAS वन (forest). We appreciate the ground-level support of Vicharta Samuday Samarthan Manch (VSSM) for this initiative of BCAS. We thank all donors for their generous contributions.

Reimagine

On 4th, 5th, and 6th of January 2024, BCAS has organised a mega-conference, ReImagining the Profession in the changing technological environment. The event shall cover many thought-provoking ideas for the future of the finance, consulting, assurance, and taxation profession. The event is open to all Chartered Accountants and other Finance professionals in Practice or in Industry. Participants from over 40+ cities and towns have already registered in numbers.

While concluding, I would like to leave a thought on technology, since this communique is dealing mainly with technology and digital transformation, which India is witnessing.

Lastly, I on behalf of the Society congratulate team ISRO for #Chandrayaan3’s successful landing. This is a historic achievement for India’s space development program and the rise of Bharat. Compliments to the visionary leadership of our country.

Technology is best when it brings people together – Matt Mullenweg